Today we’d like to introduce you to Jason Young.

Hi Jason, thanks for joining us today. We’d love for you to start by introducing yourself.

I have had a bit of a circuitous route to my career. I actually graduated with a Mechanical Engineering degree but decided before graduation that traditional engineering positions weren’t what I really enjoyed. I loved the problem-solving aspect of engineering, but also preferred a more collaborative client-facing environment. That led me to begin my career in a technical sales position in the medical device industry. While that career path initially afforded me a lot of benefits, and much of what I had been looking for, it ultimately just wasn’t as fulfilling as I had hoped. I really wanted to feel like my career was making a difference, and that I was doing something that could meaningfully impact other people’s lives in a positive manner. An opportunity arose to make a career move into the finance industry, and I jumped on it!

My path in finance provided me with different experiences in the mortgage industry, personal and commercial banking, insurance and ultimately investments, financial planning and wealth management. While I didn’t know it at the time, those varied experiences actually provided me with a lot of real-world experience in many aspects of finance that many traditional Financial Planners and Wealth Managers never receive. I feel like that background actually gives me a unique skillset when it comes to Financial Planning for clients because I know the “ins” and “outs” of how all those areas work, and how clients can best use those strategies in their individual plans.

I’m sure it wasn’t obstacle-free, but would you say the journey has been fairly smooth so far?

It was definitely not a smooth road for me. I have always had an entrepreneurial spirit, and while many advisors begin in a channel like banking, or with an insurance company, to gain experience and begin to build a client base before potentially choosing to go independent, I took a different path. I actually started as an independent solo practitioner in my hometown of Cincinnati and relied heavily on family and friends to begin building my practice while growing through referrals. It also just so happens that I began my solo practice in July 2007, not too long before the Great Recession/Global Financial Crisis began. Statistically, 80-90% of advisors tend to fail out of the business in their first three years but even in the face of those odds AND the looming recession, I was able to keep my practice alive through hard work, determination and support from my unbelievable wife. Financially, it became extremely challenging at times given that I was self-employed with no regular payroll, and my wife carried a significant portion of that financial burden during those first few years. However, after the end of the GFC and for the next few years, I was finally beginning to gain some more significant traction and accelerating growth of my client base. In 2011, we had our first daughter and my wife went through some significant challenges with postpartum depression. In 2012, we decided to relocate our family to the Youngstown area where she grew up so that she would have her mother nearby to provide support during such a difficult time.

This presented a new unique set of challenges for my practice. At the time, virtual meeting software was very new and had a lot of technical issues that caused reliability concerns. I didn’t think putting my clients through that was fair to them, and commuting 4.5 hours back and forth every week with a small child at home was also not feasible, so I made the difficult decision to transfer my existing clients over to a friend in the business that I knew would do a great job of taking care of them. Without an existing client base and no warm network of family and friends locally to look to for support, I had to re-enter the corporate world. I worked in both the insurance and banking arenas to not only support my family financially, but also to begin establishing my business reputation in this new market, and see if I could now build a new client base without the support of family and friends in order to eventually move back to an entrepreneurial role. It took me several years, but in late 2019 I felt that I had enough potential client support to make that transition back to being a solo practitioner, and so I jumped back in with both feet.

In February of 2020, I re-started that journey back to being a solo practitioner…you guessed it, just as the COVID-19 pandemic began to really take shape in March. This presented a whole new unique set of challenges as I was trying to transition clients to my new practice, our Broker/Dealer mandated a lot of restrictions regarding in-person meetings, mask mandates, etc. that made the process much more cumbersome and time-consuming which put significant strain on the expected revenue I had projected to make this opportunity feasible fiscally. However, I was really able to draw on my past experience from starting my initial practice during the GFC and apply a lot of that same ethos towards this challenging environment. Our family had also been blessed with two more children along our journey, so now having a family of five was also a huge motivation on making sure I was going to be successful in this endeavor.

Not only was I able to just make the practice survive, I ended up finding another advisor along the way to partner with, and we have thrived! Over the last five years we have grown substantially and been able to serve the community both with what we do through the business, but also through volunteer work and it couldn’t be more rewarding!

We’ve been impressed with Modern Wealth Management, LLC, but for folks who might not be as familiar, what can you share with them about what you do and what sets you apart from others?

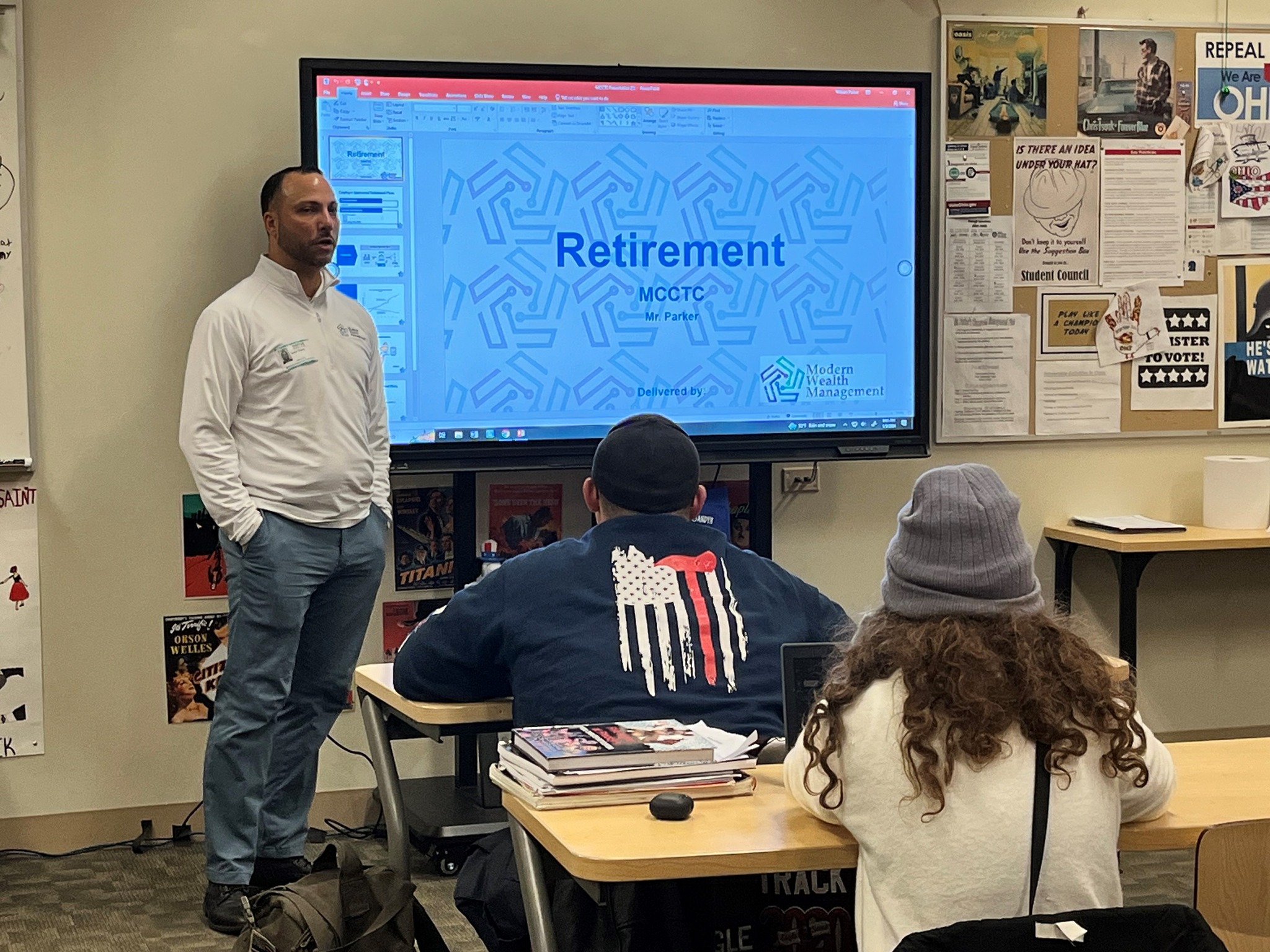

We tailor the company’s services toward those who value holistic financial planning; the process of accounting for a client’s entire financial life within their financial plan. This means encompassing a wide range of solutions involving investments, insurance, and alternative strategies for creating income, managing debt, tax efficiency, estate planning, and more. Our focus is to assist clients throughout their entire financial life, ensuring that they can not only live comfortably now but know they have a plan for their future. We take a very educational approach to financial planning and live by the motto that “If you have 1,000 questions, please ask them” as we want to make sure that every client is as informed as possible before deciding to work with us. We believe that the better clients understand the “what” and “why” behind strategies that we implement on their behalf, that results in stronger, long-term client-advisor relationships.

Being involved in our community is also extremely important to us – we live here, we are raising our families here. When they say “it takes a village” it truly does and for that reason we try to support those in our community that support us and those organizations that are near dear to our hearts.

So maybe we end on discussing what matters most to you and why?

Helping people. I have always believed that if I can lend my knowledge, experience and expertise to better others, that not only will I be successful in whatever career path I choose, but I will be doing the most important thing one can do, which is making the world a better place.

Contact Info:

- Website: https://www.modernwealthmanagement.net/

- Facebook: https://www.facebook.com/ModernWealthManagementLLC

- LinkedIn: https://www.linkedin.com/in/jasonayoungfinancialadvisor/