Today we’d like to introduce you to Drew Martin

Today we’d like to introduce you to Drew Martin

Alright, so thank you so much for sharing your story and insight with our readers. To kick things off, can you tell us a bit about how you got started?

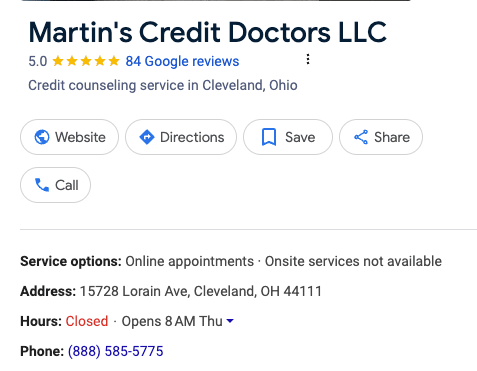

Drew Martin, a nationally recognized educator, tech entrepreneur, and credit expert based in Cleveland, Ohio, has carved out a niche in the financial industry with his company, Martin’s Credit Doctors. As the CEO, he leads a team dedicated to empowering individuals and businesses through AI-driven solutions for personal credit repair, building business credit, obtaining business funding, and debt settlement.

Drew’s professional journey began over a decade ago, and his skills in business and education have since become unparalleled. He has helped hundreds of clients and business owners maximize their potential, seize new opportunities, and achieve their dreams.

A graduate of the University of Akron with a Bachelor of Science in Education, Drew furthered his studies in the MBA program at Southern New Hampshire University. His career in credit began in 2014 after graduating with a 750 credit score. Ambitious and driven, Drew moved to Dallas, Texas, to start a real estate business, leveraging his credit score to obtain funding. However, his initial plans faltered, leaving him $25,000 in debt with a 444 credit score. Instead of filing for bankruptcy, Drew discovered federal laws (FCRA) that allowed him to dispute negative items on his credit report. He immersed himself in learning about credit repair through videos, courses, and seminars. After years of trial and error, he successfully repaired his credit and began helping friends and family.

In 2020, amidst the COVID-19 pandemic, Drew founded Martin’s Credit Doctors. Since then, he has helped hundreds of people across the country improve their credit to become homeowners and entrepreneurs. The company has expanded to assist small businesses and new business owners in securing $10,000-$250,000 to launch and scale their operations. Additionally, Martin’s Credit Doctors offers a debt settlement program, helping individuals reduce their monthly payments by 30-60%.

Martin’s Credit Doctors provides a comprehensive suite of services:

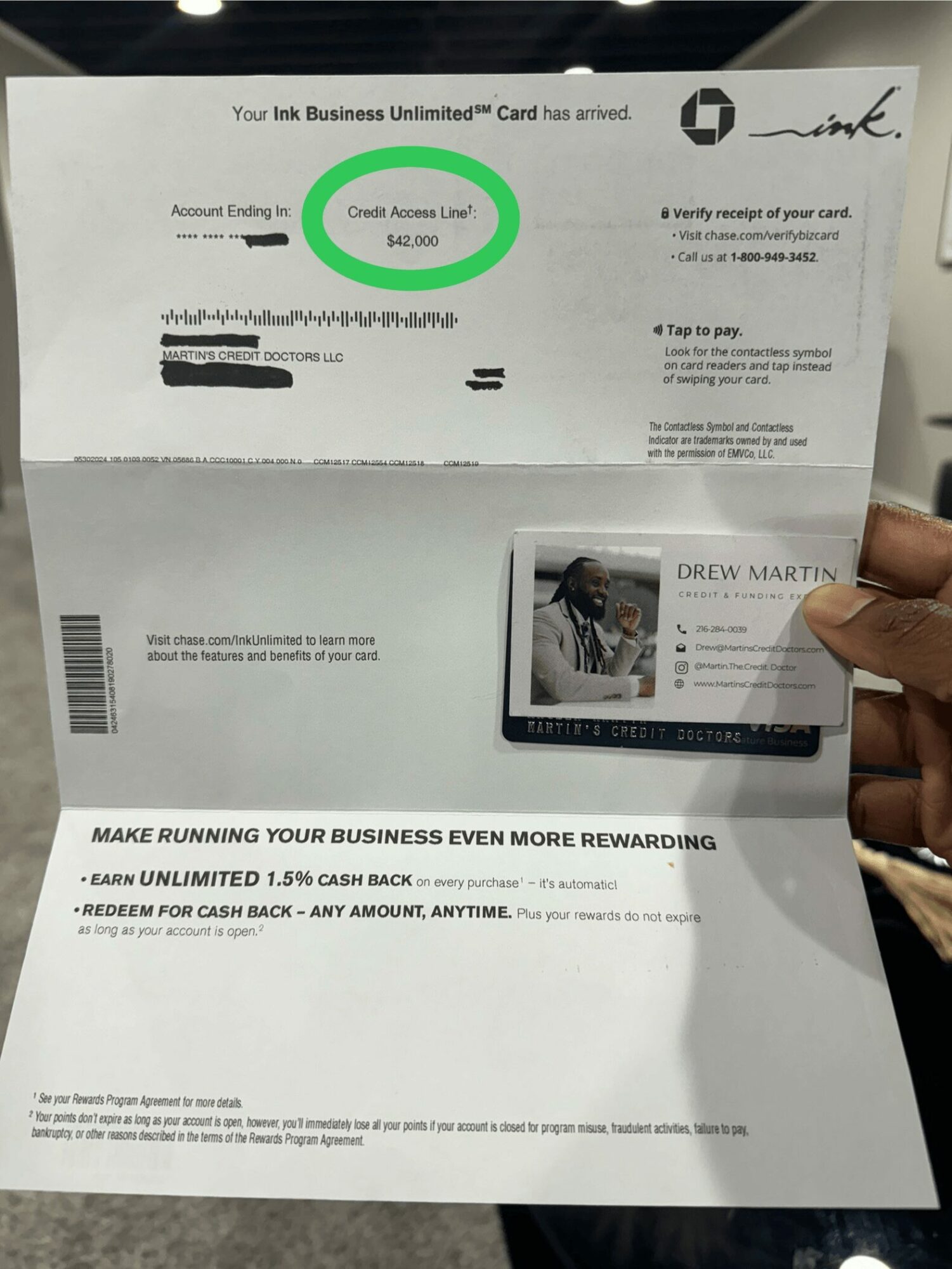

Business Funding: From business credit lines and SBA loans to equipment and inventory financing, Martin’s Credit Doctors offers various funding options to support businesses at every stage, including startup financing, revenue financing, and commercial real estate loans.

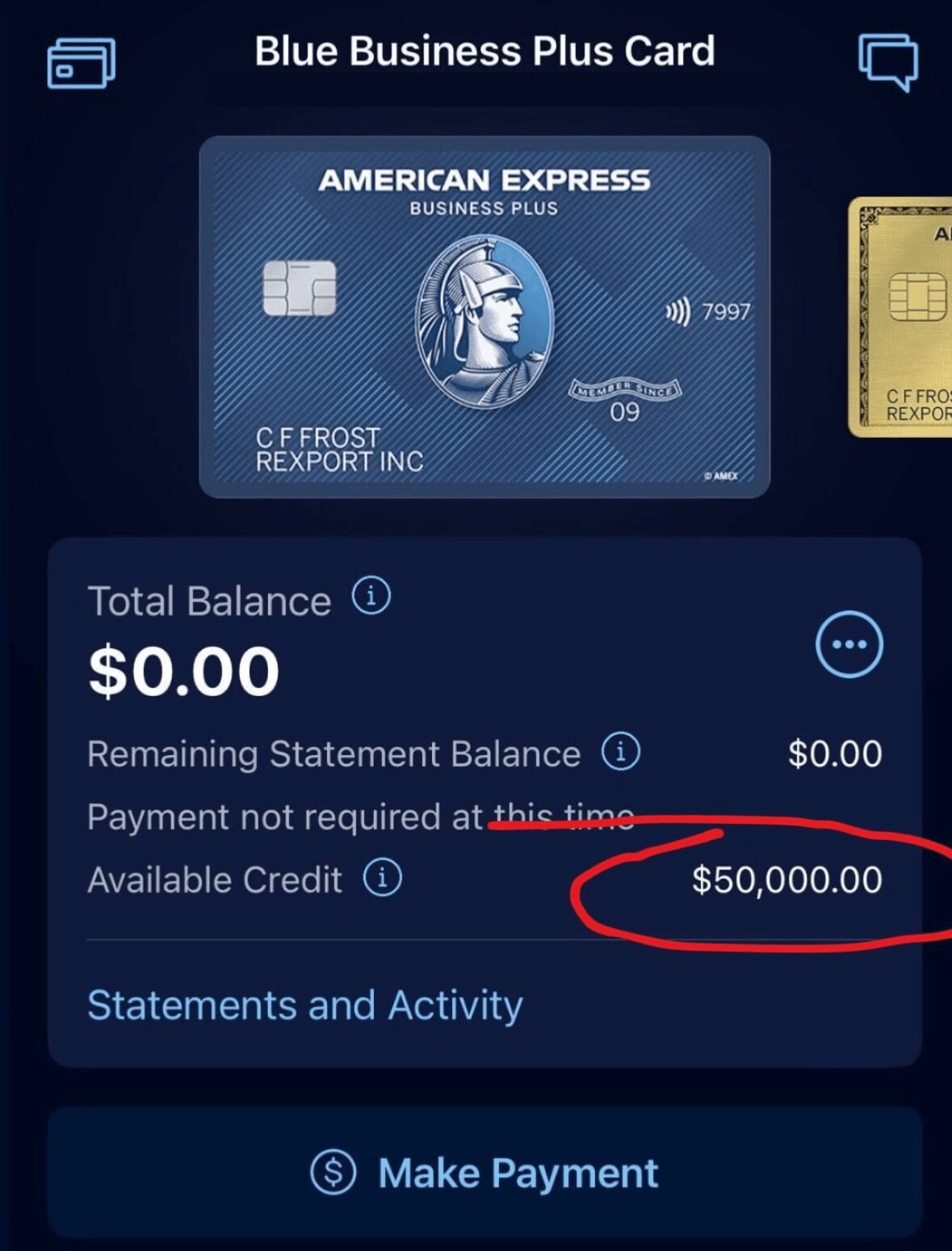

Business Credit: Specializing in securing business credit lines, including unsecured lines and credit line hybrids with 0% intro APR, the company helps businesses establish and grow their credit profiles.

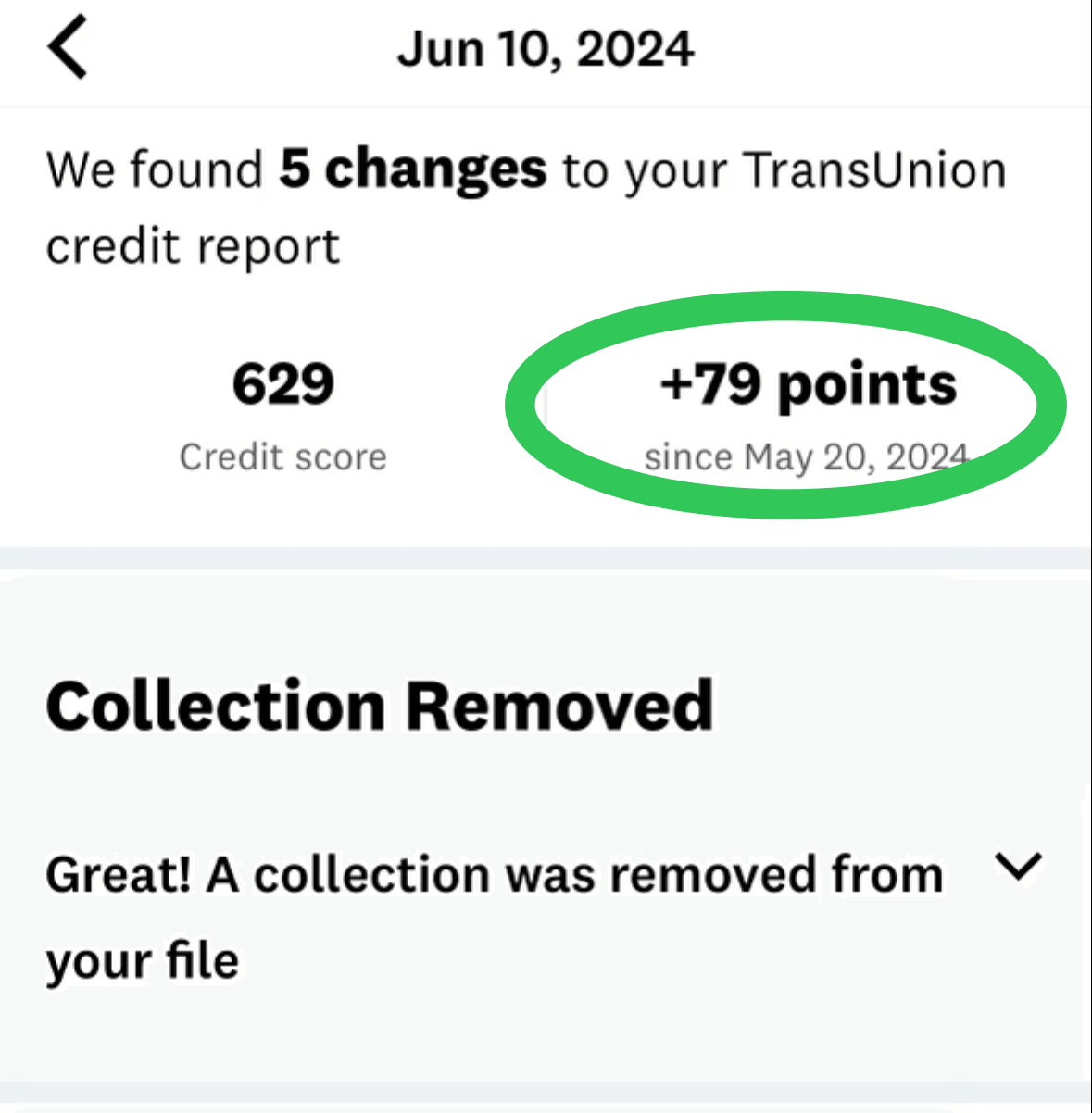

Credit Repair: Utilizing federal laws and proven strategies, Martin’s Credit Doctors helps clients dispute negative items on their credit reports, including credit card debt, payday loans, medical debt, personal loans, lines of credit, auto repossessions, mortgage debt, tax debt, and more. The company also offers an affiliate program for extending professional credit repair services to clients.

Debt Consolidation: Services to consolidate and manage various types of debt, including credit card debt, payday loans, medical debt, and personal loans. The company also handles judgments, collections, auto repossessions, mortgage debt, and tax debt.

Drew Martin’s dedication to results-driven solutions, innovation, community engagement, and excellence has not only fueled his success where many others have failed but also earned him distinguished honors and recognition from the community. His story is one of resilience and commitment, turning personal setbacks into a mission to help others achieve financial freedom and success.

We all face challenges, but looking back would you describe it as a relatively smooth road?

No, it hasn’t been a smooth road at all. My journey in the credit industry began with a significant setback. After graduating from the University of Akron with a solid 750 credit score, I ambitiously moved to Dallas, Texas, to start a real estate business. I planned to leverage my credit score to secure funding, but things didn’t go as planned. I ended up $25,000 in debt with a dismal 444 credit score. This was a major blow, and at that point, I seriously considered filing for bankruptcy.

However, during my research into the bankruptcy process, I discovered federal laws (FCRA) that could help me dispute the negative items on my credit report. This led me down a path of intense learning—watching countless videos, buying courses, and attending seminars on credit repair. It was a long process filled with trial and error, but eventually, I managed to successfully repair my credit.

Starting Martin’s Credit Doctors in 2020 amidst the COVID-19 pandemic was another significant challenge. The economic uncertainty made it a tough environment to launch a business, but I was determined to help others who were struggling with their credit. Since then, we’ve expanded our services to assist small businesses and new business owners in securing substantial funding, and we’ve helped individuals reduce their debt through our debt settlement program.

Every struggle along the way has taught me valuable lessons and has driven me to create solutions that empower others to overcome their financial challenges. My experiences have made me more resilient and more committed to helping my clients achieve financial freedom and success.

Appreciate you sharing that. What should we know about Martin’s Credit Doctors?

At Martin’s Credit Doctors, we are dedicated to empowering individuals and businesses by providing AI-driven solutions for personal credit repair, building business credit, obtaining business funding, and debt settlement. Our mission is to help our clients achieve financial freedom and success by offering comprehensive and innovative services tailored to their specific needs.

What We Do:

We specialize in:

Personal Credit Repair: Utilizing federal laws and proven strategies to dispute negative items on credit reports, including credit card debt, payday loans, medical debt, personal loans, lines of credit, auto repossessions, mortgage debt, tax debt, and more.

Business Credit Building: Helping businesses establish and grow their credit profiles by securing business credit lines, including unsecured lines and credit line hybrids with 0% intro APR.

Business Funding: Assisting small businesses and new business owners in securing $10,000-$250,000 to launch and scale their operations. Our funding options include business credit lines, SBA loans, revenue financing, equipment financing, inventory financing, commercial real estate loans, and more.

Debt Settlement: Offering a debt settlement program that helps individuals reduce their monthly payments by 30-60% and manage various types of debt.

What Sets Us Apart:

Our approach combines advanced AI-driven solutions with a deep understanding of federal credit laws, allowing us to offer unique and effective services that truly make a difference. We are known for our personalized service and commitment to our clients’ success. Unlike many others, we provide a comprehensive suite of services that cover every aspect of credit and financing, from personal credit repair to business funding and debt consolidation.

Brand Pride:

We are most proud of the tangible impact we’ve had on our clients’ lives. Helping hundreds of people across the country improve their credit, become homeowners, and grow their businesses is incredibly rewarding. Our success stories and client testimonials are a testament to the dedication and effectiveness of our services.

What We Want You to Know:

Martin’s Credit Doctors is here to support you at every step of your financial journey. Whether you’re an individual looking to repair your credit, a new business owner seeking funding to launch your venture, or a small business needing financial solutions to grow, we have the expertise and resources to help you succeed. Our innovative, AI-driven solutions and personalized approach ensure that you receive the best possible service and achieve your financial goals.

How do you think about luck?

Luck has played a significant role in both my life and business, and it has come in both good and bad forms. My journey is a testament to how luck, combined with perseverance and resilience, can shape one’s path.

Bad Luck:

Early in my career, I experienced what I would consider a streak of bad luck. After graduating with a 750 credit score, I ambitiously moved to Dallas, Texas, to start a real estate business. Despite my best efforts, my plan failed, and I found myself $25,000 in debt with a credit score of 444. This was a tough period filled with financial stress and uncertainty. At the time, it felt like everything was going against me, and I was on the brink of filing for bankruptcy.

Good Luck:

However, this phase of bad luck led to a turning point. While researching bankruptcy, I stumbled upon federal laws (FCRA) that could help me dispute negative items on my credit report. This discovery was a stroke of good luck that set me on a new path. I immersed myself in learning about credit repair, which eventually led to the founding of Martin’s Credit Doctors in 2020.

The timing of starting the business during the COVID-19 pandemic was also a mix of good and bad luck. While the economic climate was challenging, the increased focus on financial health during the pandemic created a unique opportunity for our services. This unexpected twist of fate helped us connect with many people in need of credit repair and financial guidance.

Reflection:

Luck, both good and bad, has taught me invaluable lessons. The bad luck I faced early on forced me to learn, adapt, and ultimately become an expert in credit repair. The good luck, such as discovering the right information at the right time, propelled me forward and allowed me to help others.

I believe that while luck can influence our path, it’s our response to these moments that truly defines our journey. Embracing both the good and bad luck, learning from each experience, and persevering through challenges have been crucial to my success and the success of Martin’s Credit Doctors.

Contact Info:

- Website: https://www.martinscreditdoctors.com/

- Instagram: https://www.instagram.com/martin.the.credit.doctor/